It’s the start of a new year, marked by some timeless traditions. Some of us drag out Christmas trees to the curb, others dismantle and box our Festivus poles while others pack up menorahs or kinaras. There are lights to be stowed, pine needles to vacuum and gifts to be worn, hidden, stowed, drank, returned or re-gifted. But after the cat eats the last piece of tinsel and the final unloved morsel of fruitcake is tossed, comes the hard part. How to eliminate holiday debt?

So unforgiving, that bold black text on crisp white statement. And the totals, so clearly inflated. There must be a mistake or five here. Then starts the questions and or blamings, “what was that $312.54 for?” or, “honey did you buy something from JBM Trading Company 412?”. Often there is a surprise bill or two that arrives around the same time, some medical test invoices, the annual property tax bill, or some school fees for the kids.

It all adds up to, well, more than you have in your checking account. What to do? With credit card interest at 20-30%, compounded monthly, getting rid of this debt is a 5-alarm blaze. And paying the minimum amount due is a ticket to the start of a financial apocalypse. It needs to go. All of it.

How bad is this thing?

Start by surveying the damage. Get it all out there. The paper statements, the online balances, the main credit cards and the branded store ones. And yes, even the “I only got it to get that in-store discount on that one big thing that you swore that you would never use again”, cards. Add it all up. Make up a quick table of the cards, the balances, the interest rates and the due dates. Not pretty, but at least it is all out in the open. Involve your partner in the process. Work out a plan to pay them all off. Missing due dates can lead to credit score issues, delaying the ones with the highest interest rates are costly. Work out the priorities and make a plan.

Remember the pain of all of this, since you will need that for next year’s planning.

What is the funding gap?

What do you owe and what funds do you have available? Identify how big the gap is. That is a key first step to solve the issue. Take a look at timing, when are the next paychecks coming in and which bills are due when.

Let’s pay things off

The first few moves are obvious, using available cash to pay pressing bills, but then it gets trickier – how to fund the bills that have, well, no funding. Here is a list of key action moves:

- Do you have government Covid checks coming your way? Is there any action to get them sooner? Can you register online or otherwise speed up their arrival?

- If you are expecting a tax refund, can you get your return filed sooner to access that cash?

- Are there other bills that will let you delay payments or reduce payments without penalty? Call them and see if they can help you.

- What about that $1,200 you lent your brother-in-law? Might now be the time to collect?

- Is there some part time work that you could do to get some extra cash? Overtime at work, some Uber or Lyft driving, some retail shifts or some online tutoring? Can your partner help?

- Are there some gifts that you don’t like, don’t need or could live without? Try returning them for cash refund. As a minimum, could you return them for a store credit, then sell that online? Or use the credit for essentials that would otherwise need to be paid?

- Anything else around the house that you could sell on ebay, craigslist or offerup? As an example, maybe you are now a smartwatch devotee and no longer need some dress watches.

- What changes can you make to reduce your usual monthly spend and free up cash for the bills? Going vegan for a month, reducing take out and drive through food, turning down the thermostat and of course curbing new purchases can all help. Check out my other blog posts or Cashflow Cookbook for more ideas.

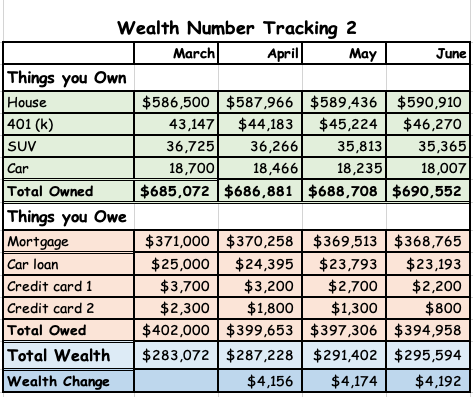

- It’s not ideal, but it might make sense to temporarily reduce payroll or other automatic savings provisions for 401ks, RSPs, company stock plans etc. to free up cash and pay off bills. Not a good long-term solution, but sacrificing a return of, say 7%-10% to pay off bills with an interest rate of 22% has some logic.

- Try calling the credit card companies. Explain that you are willing to do your best to pay, but you are overwhelmed with holiday bills and are wondering what they might be able to do to help. Worth a try.

- A final option is to take out a loan or use a line of credit to consolidate the bills and pay them off. Line of credit interest can be as low as 3 or 4%. The danger of course, is to take out one of these loans and then let your credit card balances creep up.

How to Eliminate Holiday Debt for Next Year

Of course, the best way to solve this problem is to never have it in the first place. Now that we have solved your current year problem, let’s start now to set you up right for the new year.

- Once you pay off your cards, call and cancel all but one. That’s all you need. Multiple cards are damaging to your credit score, make it easier to ring up more debt, complicate your monthly bill payment and record keeping processes and lead to more spending. Oh, and make your wallet fatter. The freebies and extra discounts from these cards don’t save you money, they just encourage more spending. One good reward card. You got this!

- If you are sweating your holiday debt, so are the rest of your family and friends. Now is the time to set an agreement that limits holiday gift value to an agreed amount. Start a family discussion, be candid and get it done. Whew!

- Or go a step further and switch to cashless gifts. Why not give vouchers to make a meal, do some house projects, kitchen cleanups, car washes or other services? A backrub for your partner? Or even promises for time together for a picnic or a hike?

- If the spending can’t change, then at least plan for it and save up. If holiday spending is, say, $1,000, then set aside $83.33 a month into a holiday gift account. Lots of banks now have set ups to let you save for a few different goals. Or just stash the cash somewhere.

- Pre plan your shopping so that you establish limits for each recipient and stick with them. Plan the gifts too so you can watch for sales, Groupon deals or discount coupons.

Hopefully that will set you on the right course and eliminate some financial stress. What other ideas do you have to help with holiday spending and debt? Let me know in the comments.

All the best to all of you for a wonderful 2021.

Gordon

photo credit Freestocks at Unsplash