Stay sane during Covid

It began with a shock as the virus spread, everything closed and markets crashed. Then things got eerily quiet. For a while doom scrolling kept us busy. Then the scramble to set up a home office and learning spaces for the kids. Next came guzzling down Netflix episodes for light drama followed by a US election for even more drama. Most recently we’ve been comparing shots and reactions. But we are all getting weary and it’s time to find new ways to stay sane during Covid.

Fine, I mean fun, dining

No question our eating has changed a lot. Emphasis on the lot. Where workday dining used to be confined to mealtimes, being at home gives us continuous access to the fridge, the pantry and the cookie jar to relieve some boredom. Here are some ideas to mix things up and stay sane during Covid:

Meal Kits – here in Ohio, our Giant Eagle grocery store has a selection of Great to Go meal kits for two including Chicken Piccata and Mushroom and Green Chile Enchiladas. Meanwhile in Canada, PC Chef has their Oaxacan Pork Tacos with Mango Salsa and smashed Avocados. They make a fun date night, are easy to prepare and build real chef skills for when you are ready to take off the culinary training wheels.

Leftovers – check out Supercook, a clever way to find recipes with what you have left in your fridge. Download their app from the App Store or Google Play and just speak your fridge leftovers into your phone. Boom! It finds you recipes that use just what you have! How Cashflow Cookbook is that?

Wine Clubs – there are some great wine clubs out there including the Wall Street Journal Wine, a cool club that starts off with 14 bottles plus glasses for just $69.99. Or why not try a complete blind tasting kit from Argaux? They offer 2, 3 and 4 bottle kits to test your palette and learn your preferences. You can set up your own testing night and compare scotches, gins or rums. We did a comprehensive vodka testing night right here at Cashflow Cookbook headquarters.

Clear out the brain fog

What a great time to learn something new! We are all used to remote connections and the range and quality of courses has never been better. Wonderful way to reinvest your commute time in ideas to enrich your life and further your career while staying sane during Covid.

Masterclass gives you full access to the best in every field. Learn songwriting with Alicia Keys, cooking with Gordon Ramsey, skateboarding with Tony Hawk or business management with Howard Shultz (think Starbucks). An unbelievable deal at $15/month.

There are lots of other great online learning sites including Udemy, Coursera, EdX and LinkedIn Learning. Titles include business related topics like mastering XL (how fun is that?) or learning to code (How much fun can you take?), to every kind of interest or hobby. Udemy, as an example, includes courses on everything from music and photography to fitness, lifestyle and interior design. Often courses with thousands of 4-5 star reviews are only $20-$40. Coursera and EdX tend to more academic and career-oriented titles.

The great outdoors

There it is, just past your screens and out your front door! Go check it out. Prop up an effigy of yourself in your office chair so you’re not missed on the Zoom call. You got this.

Hike – grab some runners and get to a park or trail. Breathe that fresh air and commune with the woodland creatures. It’s a lot like the Headspace meditation app, but without the computer, the guy with the British accent and the annual subscription. Push the pace a bit and get your heart engaged, or bring some snacks and loaf along. Either way, the latest research says that it will help you stay sane during Covid.

Bike – yah, the dusty metal thing in the garage, just behind the Christmas decorations and the boxes of, well, whatever is in them. Guessing here, but perhaps you haven’t had it out in ages. The good news is that it is just like riding a…well you know. Get a nifty phone holder for your handlebars to help your navigation or just go natural and enjoy the day.

Herb and Vegetable Gardens – A great alternative if all of that huffing and puffing isn’t your thing. Lots of instructions to get you started on YouTube and seeds and kits on Amazon. A wonderful way to commune with your own yard, and get the very freshest ingredients for your garden.

Bird watching – I know, I know, it sounds a bit fuddy duddy. Bust out the Tilley hat and the cardigan and all that. But a bird feeder set up just outside your morning coffee window really adds something. And since your boss isn’t watching, take your time, enjoy the interactions and the colorful species. Hauling the bird food around provides a great workout, which leads us to the next section.

Home workouts

Sadly, all of the excuses are gone! The gyms may be closed, but you can set up a home gym. Peloton, Bowflex and NordicTrack are all shipping again. And even if they weren’t your body weight is still there. Maybe more than ever. Get some basic equipment and then amp it up with bespoke virtual classes.

YouTube has every kind of workout and tons of instruction in Yoga, pilates, bodyweight, and Martial Arts. If the Apple elves brought you a watch for Christmas, put it to work with the Apple Fitness+ app. Love this, new classes all the time to bring your treadmill, spin bike, yoga mat and abs to life.

Honeydew list

Since you are at home staring ceaselessly anyway, why not fix a few things up? Tradesmen are booked solid, but what a great time to learn some new skills. Recruit a handy relative or try working under the wing of a pro. There are YouTube channels for every kind of fixit project. Bob Vila and Vancouver Carpenter are awesome for general repairs, while Appliance Repair is great for fixing, well, you know.

If your boredom sinks to previously unexplored levels, it might be time to do the sorting and organizing that you have put off for the last decade or two. Do some robust purging, move those old treasures out to charity and then get some shelves going to give you primo access to the things you really need. Cleaning, sorting, purging and organizing rivals meditation and Xanax for mood improvement.

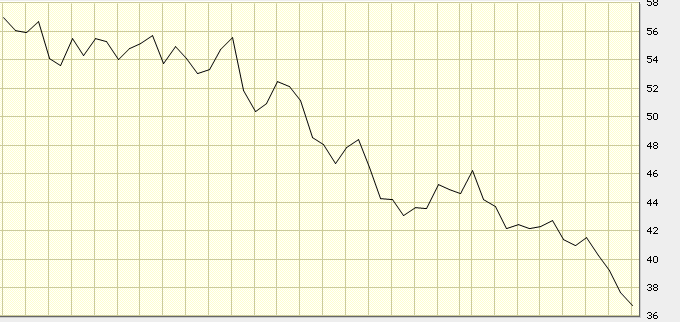

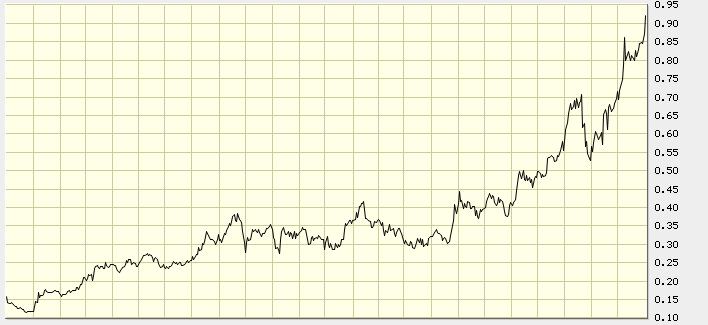

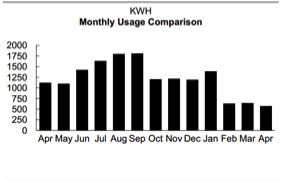

Looking to ease your boredom, stay sane during Covid and save money? Tackle some energy saving projects, like weatherstripping some leaky doors and windows, sealing around pipes entering your home and adding attic insulation. We did a few Covid-era projects to save on electricity and it made a big difference. See below:

Build a kit

You name it, you can get a kit for it. Deb got me a Les Paul guitar kit that will have me sanding, staining and soldering for weeks. Once done, I will plug it into one of the amp kits I built earlier for a real all-built-at-home experience. To ensure that I can enjoy really great guitar tone, we just got tickets for a Santana concert later this summer.

If you trend to more arts and crafts, here is a cool hands casting kit to immortalize your paws. Or you can find books and kits to make everything from candles to clocks.

Entertainment in a box

A bunch of companies will ship you a monthly box, of well, cool stuff. Hot sauces, mystery games, puzzles, at-home escape rooms, luxury essentials and tons more. Check out Cratejoy as an example. Prices run from $20-$40 a month or so.

Summary

Turns out that there are lots of ways to stay sane during Covid. As scary and as sad as this chapter has been, its also been a time to regroup, reconnect and recharge. Maybe a change to remake your life in a new way. For many it has opened possibilities – more working from home, less commuting, more free time for family. Some of these changes can help free up cash (one less car? reduced commuting costs?), while others can offer a better lifestyle (more time with kids, spouse and pets). Use the time as a chance to improve every aspect of your life. Soon the fog will lift, the world will open up and we will appreciate relative visits, dinners out and concerts like never before.

How are you staying sane during Covid? Let me know in the comments below.

Main Photo by Priscilla Du Preez on Unsplash